The Best Guide To Best Broker For Forex Trading

The Best Guide To Best Broker For Forex Trading

Blog Article

The Single Strategy To Use For Best Broker For Forex Trading

Table of ContentsGetting The Best Broker For Forex Trading To WorkThe 5-Minute Rule for Best Broker For Forex TradingHow Best Broker For Forex Trading can Save You Time, Stress, and Money.Unknown Facts About Best Broker For Forex TradingBest Broker For Forex Trading Fundamentals Explained

Considering that Foreign exchange markets have such a huge spread and are used by a massive number of individuals, they provide high liquidity in contrast with various other markets. The Forex trading market is continuously running, and thanks to contemporary innovation, is easily accessible from anywhere. Thus, liquidity refers to the fact that any person can acquire or offer with a simple click of a switch.As an outcome, there is always a possible seller waiting to get or offer making Foreign exchange a liquid market. Cost volatility is one of one of the most essential aspects that help choose the next trading step. For short-term Foreign exchange investors, rate volatility is essential, because it portrays the per hour adjustments in a possession's value.

For lasting investors when they trade Foreign exchange, the rate volatility of the market is also fundamental. One more substantial benefit of Foreign exchange is hedging that can be applied to your trading account.

An Unbiased View of Best Broker For Forex Trading

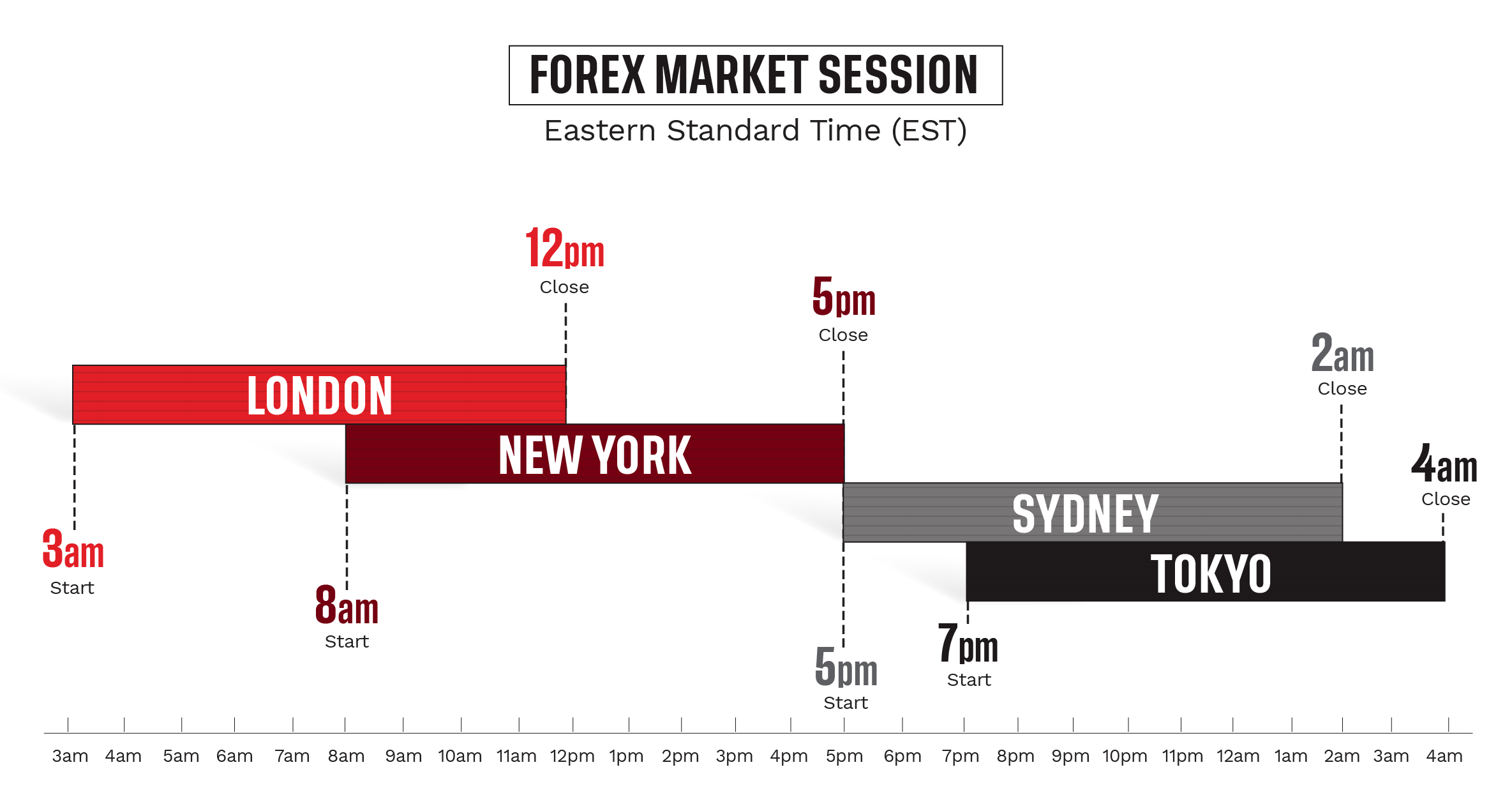

Depending on the moment and initiative, traders can be split right into categories according to their trading style. A few of them are the following: Foreign exchange trading can be effectively applied in any one of the strategies over. Due to the Foreign exchange market's excellent quantity and its high liquidity, it's feasible to enter or leave the market any time.

Foreign exchange trading is a decentralized innovation that operates without any main management. That's why it is a lot more susceptible to fraudulence and other sorts of dangerous tasks such as misleading assurances, extreme high threat degrees, and so on. Thus, Forex regulation was developed to develop an honest and ethical trading perspective. An international Forex broker have to comply with the standards that are defined by the Forex regulatory authority.

Therefore, all the transactions can be made from anywhere, and given that it is open 24 hours a day, it can likewise be done at any type of time of the day. For instance, if a capitalist lies in Europe, he can trade during North America hours and check the relocations of the one money he wants (Best Broker For find this Forex Trading).

The 8-Second Trick For Best Broker For Forex Trading

The majority of Foreign exchange brokers can offer a very low spread and decrease or even eliminate the trader's prices. Capitalists that choose the Forex market can enhance their earnings by avoiding fees from exchanges, down payments, and various other trading tasks which have added retail deal costs in the stock market.

It provides the alternative to go into the market with a little budget plan and profession with high-value currencies. Some traders might not fulfill the needs of high leverage at the end of the transaction.

Forex trading may have trading terms to shield the market participants, yet there is the threat that someone might not respect the agreed agreement. The Forex market works 24 hours without quiting.

The larger those ups and downs are, the higher the cost volatility. Those large changes can evoke a sense of unpredictability, and sometimes traders consider them as an opportunity for high earnings.

The Greatest Guide To Best Broker For Forex Trading

Some of the most unpredictable currency sets are taken into consideration to be the following: The Foreign exchange market offers a great deal of opportunities to any kind of Forex investor. As soon as having actually made a decision to trade on international exchange, both knowledgeable and newbies require to specify their economic approach and obtain acquainted with the conditions.

The material of this post shows the author's point of view and does not always show the main placement of LiteFinance broker. The product released on this web page is attended to informative purposes just and must not be thought about as the provision of financial investment recommendations for the purposes of Instruction 2014/65/EU. According to copyright legislation, this short article is considered copyright, that includes a prohibition on duplicating and dispersing it without approval.

If have a peek at these guys your firm works globally, it is very important to understand exactly how the worth of the U.S. buck, about various other money, can considerably impact the rate of products for united state importers and merchants.

Some Of Best Broker For Forex Trading

In the very early 19th century, currency exchange was a significant part of the procedures of Alex. Brown & Sons, the first investment financial institution in the USA. The Bretton Woods Contract in 1944 called for currencies to be fixed to the US dollar, which was in turn secured to the price of gold.

Report this page